Organizing your work as an independent insurance agent.

A Day in the Life of an Independent Insurance Agent

A day in the life of an independent insurance agent is busier than the Nairobi-Nakuru highway during the festive season. From chasing leads and filling out paperwork to negotiating with insurance companies and resolving client complaints—it’s a full plate, and it all falls on one person. With so much to juggle, it’s easy to feel overwhelmed and end up doing a lot, yet accomplishing very little.

That’s why having a clear work structure is essential. It not only sets you up for success but also helps you maintain a healthy work-life balance. And let’s be honest—some days everything flows smoothly, while other days feel like trying to squeeze six lanes of traffic into a two-lane road. Remember, being busy doesn’t always mean being productive. The key is to be organized to navigate both.

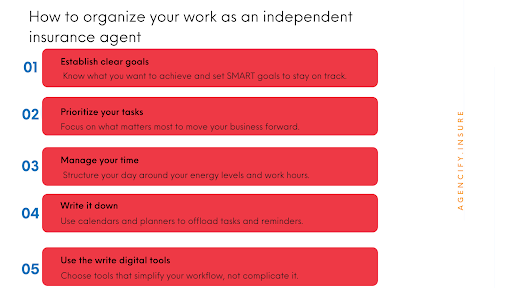

Five Ways To Organize Your Work As An Independent Insurance Agent

Establish clear goals.

Define what success looks like for you. Whether you want to generate more leads, retain existing clients, or grow your business, having a clear direction helps you stay focused. Use the SMART goal-setting method—Specific, Measurable, Achievable, Relevant, and Time-bound—to structure your objectives. Effective goal setting will require you to look ahead, see where you want to be in 3 years or 5 years. Once you have the big goals, break them down to smaller, actionable steps or weekly goals.

Example: At the end of every week (Friday), go over your goals for the week to see what you achieved and what did not work; afterwards, set new goals for the upcoming week. You may have set a goal to call 10 clients by the end of the week, however, you only managed to call 7. Reflect on what prevented you from calling the remaining three? And what can you do to hit the target next week? Other goals could be: Renew 12 policies that are about to expire, attend two industry webinars, etc. Staying consistent with this routine allows you to be on top of business and moves you closer to your goals.

Not sure what goals to focus on? Don’t worry, we’ve got you covered. Check out our previous blog, must-have goals for insurance agents for clear, actionable goals to set you up for success.

Prioritize your tasks.

Once your goals are set, identify the tasks that matter most. Prioritizing helps you allocate your time and energy effectively, ensuring you’re always working on what will make the biggest impact.

Example: First thing Monday morning, list all the tasks you need done for the day and the week. Categorize them into most urgent to least urgent, as well as the resources needed to complete them. At the start of each work day identify your top 3 must-do tasks, such as calling back a hot lead, reviewing an expiring policy, and submitting a time-sensitive claim form. Doing this will guide the flow of your work day, ensuring that by the end of the day, you will have completed the most important tasks.

Plan the flow of your workdays.

Set clear work hours and align demanding tasks with your peak energy times. For example, tackle complex work like calling clients in the morning when you’re most alert, and save simpler tasks, such as filing paperwork, for when your energy dips.

Read this Forbes article on techniques to structure a productive workday.

Example: Having identified your priority tasks, set aside time to do them. One way is by blocking your time to complete specific tasks. Set aside time for recurrent tasks, such as filing claims first thing in the morning, while meeting clients during mid-morning and early afternoon. Attending networking events and upskilling can be carried out in the evening. Make sure to consider your energy levels throughout the day.

Please remember to set aside time for breaks and rest.

Use planners and calendars for your work.

Don’t rely on memory alone; use a system to track tasks, appointments, and reminders. Whether it’s a digital planner or a physical notebook, choose a method that suits your workflow and helps you stay organized. The human mind is better at generating ideas than storing them, so use tools that help offload information and reminders.

Example: Use Google Calendar or your preferred calendar app to schedule meetings and set recurring reminders for policy renewals, or keep a bullet journal to track daily and weekly priorities. This allows your mind to be clutter free.

Use relevant digital tools.

Productivity tools should simplify your workflow, not complicate it. Instead of juggling multiple apps, consider using an all-in-one solution. For independent insurance agents, the Agencify App is a smart choice. Designed specifically for agents, it allows you to:

- Sell insurance directly from your smartphone.

- Keep a clear record of clients and prospects in a secure database.

- Proactively manage client claims and renewals, and all within a secure platform

- Match your clients with the best policies to meet their needs.

Set up Agencify to help you manage your insurance business. Download the Agencify app from Google Play Store. Read more about Agencify here.

Final thought

Organization isn’t about being rigid, it’s about creating systems that give you more control, clarity, and confidence in your work. With clear goals, solid priorities, and the right tools, you can do more in less time and with less stress.

Start small, stay consistent, and remember: even the busiest highway runs smoothly with the right traffic rules in place.

To schedule a demo of the Agencify app, Call/WhatsApp or email us at, 0706 78 78 78/ 0706 40 42 26 or contact@agencify.insure