Technology is rapidly transforming businesses. As a result, Agencify has emerged as a shining example of innovation within the insurance sector. Founded on a vision of making insurance accessible, simple, and responsive, we have been on an inspiring journey to revolutionize the way independent insurance agents operate and interact with insurers and insurance clients. With a mission to provide a convenient and easy-to-use insurance management platform that empowers agents, Agencify has become a cornerstone of change in the insurance landscape.

Filling a Crucial Gap: How Agencify Started

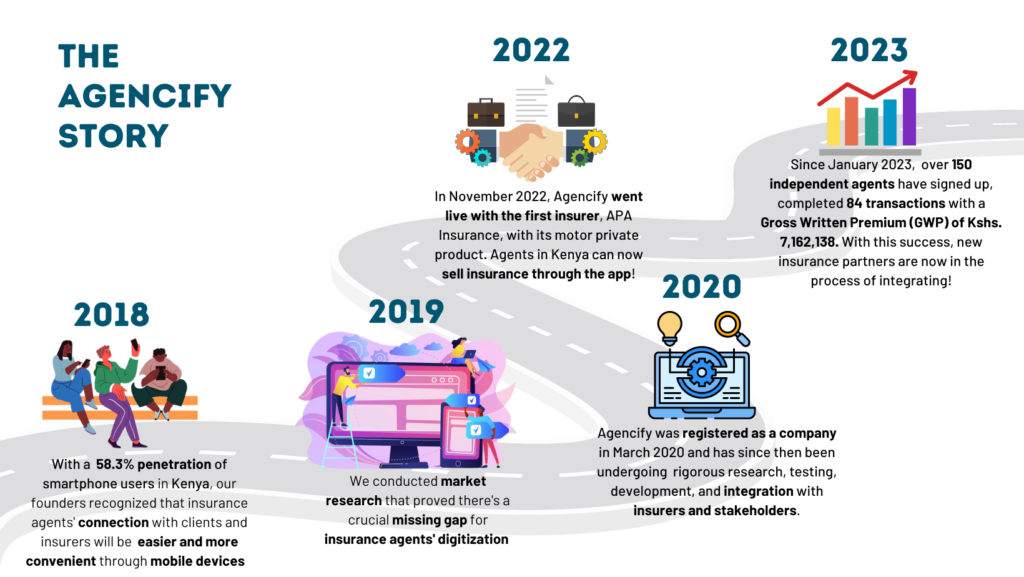

The seeds of Agencify were sown 25 years ago, when the founders embarked on a mission to build enabling software for the insurance ecosystem across Africa through a native integration to the TurnQuest system, which is provided by Turnkey Africa. This endeavor granted them profound insights into the complexities of insurance regulations, sales processes, and administrative requirements. In the process, in 2018, they identified a critical missing piece in the insurance digitization puzzle – independent insurance agents lacked the necessary tools to sell efficiently in a market hungry for digital transformation. This birthed the idea of Agencify. This infographic breaks down our story:

Addressing Agents’ Challenges With Revolutionary Solutions: Agencify

Agencify steps in to address the diverse challenges faced by independent insurance agents in Kenya, providing innovative solutions that transform their operations and enhance their effectiveness:

Challenges:

- Tedious Manual Work and Paperwork: Agents spend extensive hours manually recording data, leading to time wastage and potential errors.

- Traveling and Departmental Silos: Agents often face the need to travel to insurers’ offices, contending with delays due to departmental barriers while managing policies, claims, or documents.

- Dealing with Multiple Portals: Navigating multiple portals, insurers, and service providers introduces complexity and unproductive time consumption that could be better utilized for pursuing new business.

- Lack of Critical Information: Agents lack instantaneous access to crucial customer data, hindering their ability to provide personalized service.

Solutions:

Agencify’s groundbreaking solutions empower independent insurance agents by:

- Boosting Efficiency: The Agencify platform equips agents with seamless access to policy information, integrating systems for efficient new business acquisition. Its digital toolkit liberates agents from laborious tasks, enabling more strategic and income-generating activities.

- Seamless Renewals, Payments, and Claims Status Updates: Agencify’s digital capabilities ensure swift access to policy information, streamlined payment processing, and real-time claims status updates, regardless of the agent’s location.

- Unified Ecosystem for Stakeholders: Acting as a central hub, Agencify establishes seamless connections among agents, insurers, and clients, simplifying interactions and enhancing transparency.

- Enhanced Remote Operations: Agencify empowers agents with digital tools that enable remote work, reducing the need for on-site visits to insurer premises and enhancing overall efficiency.

- Boosting Income Potential: By relieving agents of administrative burdens, Agencify paves the way for increased income potential. Agents can channel their efforts into lead generation, client relationship nurturing, and new business closure.

Partnering with Insurers: Agencify’s Impact

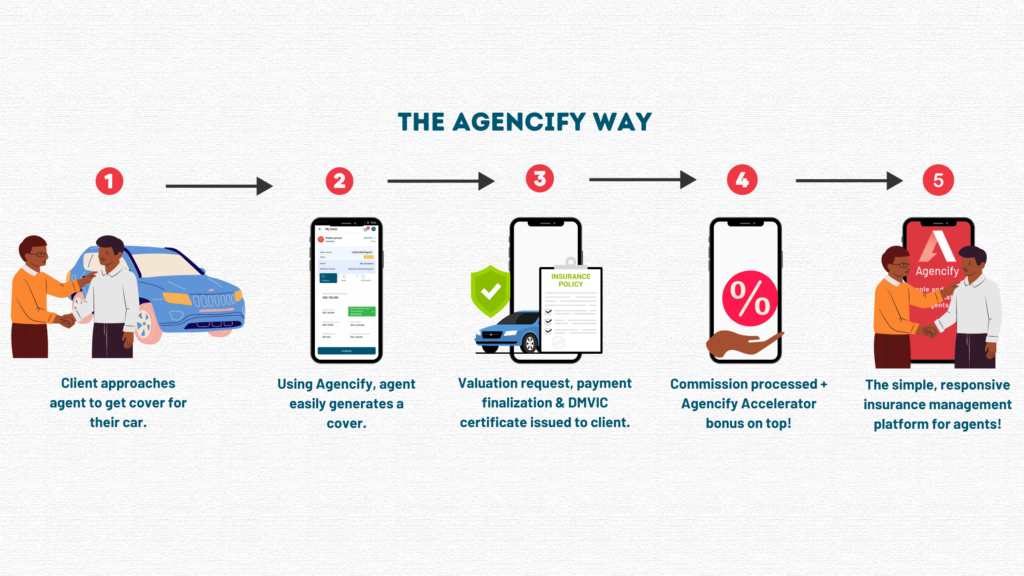

As Agencify continues to onboard more insurers, we remain at the forefront of reshaping the insurance industry. From our first insurer APA Insurance, and the addition of Takaful Insurance of Africa, with the motor private products, Agencify’s dedication to bringing transformational change to agents and insurers alike continues.

Conclusion

The insurance industry is filled with ever-evolving customer expectations. Agencify stands as a beacon of innovation, empowerment, and collaboration in the insurance sector. With a vision to simplify and reshape insurance, we have not only reimagined the agent-insurer relationship but also paved the way for a future where insurance is accessible and responsive to independent agents.

As an insurance agent, you hold the power to redefine your success. By embracing Agencify’s cutting-edge insurance management platform, you can solve the challenges you face every day in your business, elevate your efficiency, and expand your income potential. Seize this opportunity to be at the forefront of a transformative journey—one that propels your career to new heights.

Your future starts now—don’t miss your chance to shape it with Agencify. Reach us through these contacts:

Email: contact@agencify.insure

Call/WhatsApp: 0706 787878