20 Smart Ways to Generate Insurance Leads Online – Part 1

Insurance is a business that heavily relies on building relationships. Therefore, it is crucial for agents to establish strong connections with potential customers in order to succeed and generate enough leads.

However, the fact that the insurance industry is highly competitive makes it challenging for new agents to acquire leads, especially in the initial stages. To avoid facing such challenges, it is essential that agents learn effective and cost-efficient methods of obtaining insurance leads quickly.

This is a two-part, comprehensive article that will provide agents with 20 smart ways they can generate insurance leads. We’ll cover the first 10 ways in this part. Let’s dive in:

1. Customer Referrals:

Customer referrals are a valuable and cost-effective way to generate insurance leads. By leveraging the connections of your existing customers, you can tap into their networks and reach potential customers who may be interested in your insurance services. To encourage referrals, you can implement a referral program where customers are incentivized to refer their friends and colleagues. This can be done by offering discounts or rewards for successful referrals. By actively seeking customer referrals, you can expand your reach and acquire high-quality leads.

2. Use Social Media:

In our previous article, we talked about how agents can leverage digital channels to connect with potential clients. Social media is a good example of such digital channels. Platforms such as Facebook, Twitter, Instagram, LinkedIn, and TikTok offer immense opportunities to reach a wide audience and generate insurance leads. By leveraging the popularity and reach of social media, you can engage with potential customers, share valuable content, and establish your brand presence. It is important to note that while social media is a powerful lead generation channel, it is also highly competitive. Therefore, it’s crucial to develop a strategic approach, create engaging content, and differentiate yourself from competitors to effectively generate leads. Visit our social media platforms to see examples of how you can create social media content. Follow these links to go to our pages: Facebook, Twitter, Instagram, and LinkedIn.

Another important aspect of social media is monitoring social media conversations about your company. This is essential for maintaining a positive online reputation and engaging with potential leads. Regularly check social media platforms for mentions of your company and actively respond to both positive and negative feedback. Engaging with customers’ comments, questions, and concerns demonstrates your commitment to excellent customer service and can influence the perception prospects may have about your company. By actively participating in online conversations, you can also nurture relationships, address concerns, and ultimately generate leads.

3. Cold Calling:

Cold calling involves reaching out to potential leads who may have expressed interest or fit the profile of your target customers. This method requires purchasing lead lists or conducting research to identify potential leads. Cold calling can be challenging and time-consuming, but when done effectively, it can yield positive results. The key to successful cold calling is to have a clear script, demonstrate knowledge about the prospect’s needs, and offer a compelling reason for them to consider your insurance services.

4. Google Search Ads:

With the increasing reliance on Google for research and information, utilizing Pay-Per-Click (PPC) advertising can be an effective way to generate insurance leads. By running targeted ads on Google search, you can position your insurance business in front of potential customers who are actively searching for insurance-related information. PPC advertising allows you to control your budget and pay only when users click on your ads, making it a cost-effective lead generation strategy.

5. Email Marketing:

Email marketing is a powerful tool for nurturing leads and generating conversions in the insurance industry. By sending regular newsletters to your customer base, you can keep them informed about new insurance products, services, and important updates. Effective email marketing campaigns can also encourage prospects to share the email with others, expanding your reach and potentially generating new insurance leads. Building an email list may require time and investment in content creation, but it can yield significant returns in terms of lead generation and customer engagement.

6. Get Listed on Reputable Review Sites:

Online reviews have a significant impact on customers’ purchasing decisions. Getting your insurance business listed on reputable review websites such as Google My Business can boost your online credibility and attract leads. Positive reviews and ratings from satisfied insurance customers can instill trust and confidence in potential customers, increasing the likelihood of them reaching out to your company for insurance services. Encourage satisfied customers to leave reviews, and promptly address any negative feedback to maintain a positive online reputation.

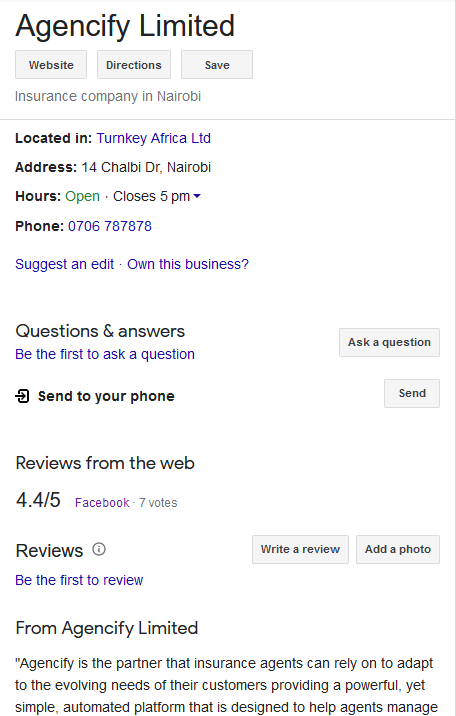

In the screenshot below, you see how we have listed Agencify on Google My Business. Follow this link to view it on Google.

7. Create a Blog:

Creating a blog is an excellent way to attract insurance leads and increase online visibility for your insurance business. By consistently producing valuable and relevant content, you can establish yourself as a trusted source of information in the insurance industry. A blog allows you to address common concerns, provide tips and insights, and showcase your expertise. By guiding potential customers through your sales pipeline with informative blog posts, you can capture their interest and convert them into leads.

Take, for example, the blog section on our website. We understand the importance of knowledge sharing. Therefore, we use this blog to provide insurance agents with valuable insights and industry updates. Through carefully crafted articles, we tackle pressing concerns, share sales tips, write about industry trends, and offer a wealth of information to help agents stay informed and excel in their roles.

8. Create a Good Website:

A well-designed and informative website is essential for attracting insurance leads. With many people searching the internet for insurance products, your website serves as a digital storefront that can make a strong impression on potential customers. It should be professional, user-friendly, and provide easy access to relevant information about your company and services. By optimizing your website’s navigation and ensuring it contains comprehensive details about your offerings, you increase the chances of attracting and converting leads.

9. Search Engine Optimization (SEO):

Search Engine Optimization is the practice of optimizing your website to rank higher in search engine results. By implementing SEO strategies, you can increase your website’s visibility and attract organic traffic from users searching for insurance-related keywords. Effective SEO involves keyword research, optimizing website content, improving site speed and mobile responsiveness, and building quality backlinks. By appearing higher in search results, you enhance your chances of being discovered by potential leads actively seeking insurance services.

10. Provide excellent customer support:

Delivering exceptional customer support is not only crucial for retaining existing customers but also for generating insurance leads through positive word-of-mouth recommendations. When customers have a positive experience with your company’s support team, they are more likely to share their satisfaction with others. This can lead to referrals and recommendations, bringing in new leads. Invest in training your support staff, address customer queries promptly, and go above and beyond to exceed their expectations.

Also, consider adopting an insurance management platform for your insurance business in order to improve customer support. An insurance management mobile app can significantly enhance your ability to provide excellent customer support to your clients because it can offer convenient access to policy information, client account management, instant quotes, and more.

Agencify, our insurance management mobile app, is a powerful tool that empowers agents like you to deliver exceptional customer support to their clients. With Agencify, you can access client information in real-time and provide personalized assistance. The app enables agents to promptly generate motor private policies and receive instant DMVIC certificates all from the convenience of their mobile phones. It also has a ToDo feature where agents can create reminders for appointments and meetings. This ensures that agents never miss client meetings, and helps to build stronger relationships with clients in the long run.

To get a demo of the Agencify app and sign up to start using the app, reach out to us on: Call/WhatsApp on 0706 787878 or email contact@agencify.insure.